Edelweiss Business Cycle Fund is a thematic/sectoral mutual fund scheme being launched by Edelweiss Mutual Fund. The Fund has Factor investing, which involves selecting stocks based on specific characteristics that are believed to contribute to their performance.

Edelweiss Business Cycle Fund – The Complete NFO Review

The Business Cycle fund was launched on July 9th, 2024, and will close for new unit subscriptions on July 23rd, 2024, so lets check out the new fund offer review in detail.

Key Details

- Fund Name: Edelweiss Business Cycle Fund

- Fund Type: Equity – Thematic / Sectorial Fund

- NFO Period: 9th July 2024 – 23rd July 2024

- Fund Manager(s): Mr. Bhavesh Jain, Mr. Bharat Lahoti & Mr. Amit Vora (For Overseas Securities)

- Benchmark Index: Nifty 500 TRI

- Minimum Investment Amount:

- SIP: Minimum Rs. 100/- and in multiples of Re. 1/- thereafter.

- Lumpsum: Minimum Rs. 100/- and in multiples of Re. 1/- thereafter.

- Exit Load:

- If the units are redeemed /switched out on or before 90 days from the date of allotment – 1% of the appliable NAV.

- If the units are redeemed /switched out after 90 days from the date of allotment – NIL

Investment Objective

With this Edelweiss NFO review, we will see the objective as this Fund seeks to generate long-term capital appreciation by investing predominantly in equity and equity-related securities. It focuses on navigating business cycles through dynamic allocation between various sectors and stocks at different stages of the economy’s business cycles.

Fund Management

Bhavesh Jain – [Co-Head – Factor Investing – Edelweiss]

Bhavesh started his career with Edelweiss Asset Management in January 2008 and has over 15 years of rich experience in the financial markets. He joined the Low-Risk Trading team and was responsible for looking at arbitrage between SGX Nifty and NSE Nifty, along with normal cash-future and index arbitrage.

He has a Master’s in Management Studies from N.L. Dalmia Institute—Mumbai University and an MBA in Finance from Mumbai University.

Bharat Lahoti – [Co-Head – Factor Investing – Edelweiss]

Mr. Bharat has 18 years of experience in portfolio management, macro, and sector research. He has worked with marquee investment banks and asset management companies.

His last assignment before joining Edelweiss Asset Management Limited was as a senior manager with DE Shaw Group, a global hedge fund, where he worked on fundamental and quantitative research ideas.

Investment Strategy

The Edelweiss Business Cycle Fund evaluates businesses and selects stocks for its portfolio through a comprehensive process that combines key factors to spot trends in the business cycle. The Edelweiss mutual fund’s investment philosophy is based on a proprietary model that analyzes Growth, Quality, Value, and Momentum factors. Here is an overview of the stock selection process:

Stock Selection Process:

- Filter from Top 300 Stocks: To create an investable universe, the fund starts by filtering the top 300 stocks by market capitalization.

- Calculate Scores: Each stock in the universe is then evaluated across factors such as Quality, Growth, Value, and Momentum. Scores are assigned based on these factors.

- Select Top Ranked Stocks: Stocks with the highest scores in factor combinations like Value+Momentum, Growth+Momentum, and Quality+Momentum are selected.

- Construct Portfolio: A portfolio of approximately 60 stocks is constructed across the large-cap and mid-/small-cap universe based on the selected top-ranked stocks.

Investment Philosophy:

- The fund’s proprietary model analyzes factors to identify business cycle trends.

- Key factors used in the model include Growth, Quality, Value, and Momentum.

- The model aims to maintain equal allocation between large and mid/small caps.

- Sector exposure is capped at 40%, and single-stock exposure is limited to 10%.

Risk Filters:

- The fund incorporates risk filters to manage risk effectively in the stock selection process.

- The fund aims to select stocks with a balanced risk-return profile by calculating scores across multiple factors.

Benchmark Agnostic Approach:

- The fund follows a benchmark-agnostic approach, focusing on constructing a portfolio of stocks performing well in the current business cycle.

- The sector exposure is managed within predefined limits to ensure diversification and risk control.

Performance and Risk Analysis

The fund believes in investing using a factor-based approach to capture trends in business cycles.

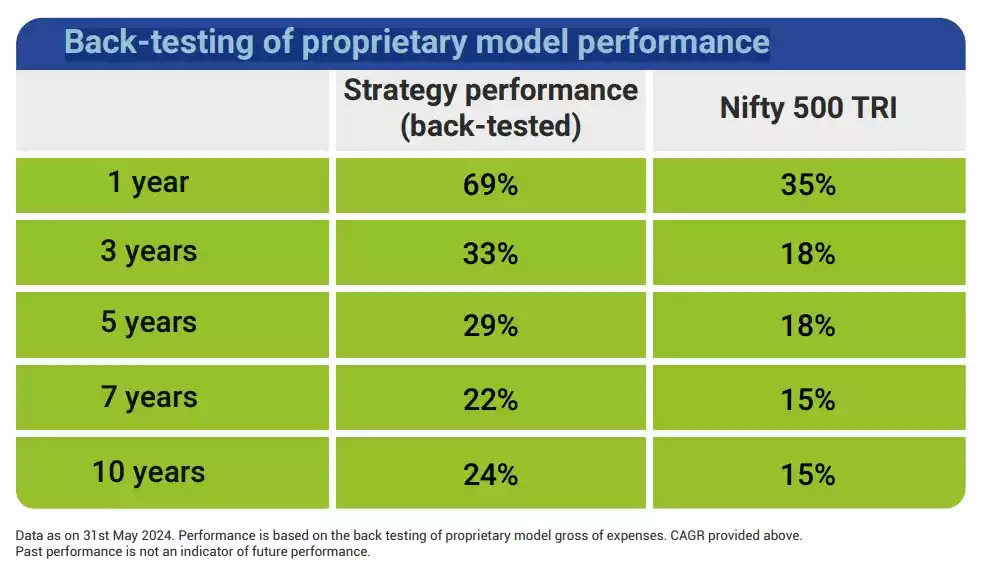

Back-testing of proprietary model performance is as follows:

Target Audience

This product is suitable for investors who are seeking:

- Long-term capital appreciation

- Investment in equity and equity-related instruments with a focus on navigating business cycles through dynamic allocation between various sectors and stocks at different stages of business cycles in the economy.

- Investors should consult their financial advisers if they doubt whether the product suits them.*

Why Invest in Edelweiss Business Cycle Fund NFO?

Investing in the Edelweiss Business Cycle Fund can be beneficial for several reasons:

- Dynamic Allocation: The fund focuses on navigating business cycles through dynamic allocation between various sectors and stocks. This approach can help capitalize on opportunities presented by different stages of the economic cycle.

- Proprietary Model: The fund’s investment strategy is based on a proprietary model that analyzes key factors such as Growth, Quality, Value, and Momentum. This systematic approach can potentially lead to better stock selection and performance.

- Risk Management: The fund incorporates risk filters to manage and mitigate potential risks in the stock selection process. By aiming for a balanced risk-return profile, the fund seeks to optimize returns while controlling volatility.

- Diversification: The fund offers diversification benefits with a portfolio of approximately 60 stocks across large and mid-/small-cap universes. Equal allocation between market capitalizations and sector exposure management can help spread risk.

- Benchmark Agnostic Approach: The fund follows a benchmark-agnostic approach, allowing flexibility in-stock selection and sector allocation. This approach can lead to outperformance compared to traditional benchmark-constrained funds.

- Expert Fund Managers: The fund is managed by experienced fund managers, Mr. Bhavesh Jain and Mr. Bharat Lahoti, who bring their expertise and knowledge to the investment process.

- Long-Term Capital Appreciation: The fund aims to generate long-term capital appreciation by predominantly investing in equity and equity-related securities. This strategy aligns with growing your investment over the long term.

- Business Cycle Focus: The fund aims to capture opportunities for growth and performance by focusing on business cycle trends and selecting stocks well-positioned for different cycle phases.

- Transparency and Information: The fund provides detailed information on its investment philosophy, stock selection process, and performance metrics, allowing investors to make informed decisions.

Conclusion

Overall, investing in the Edelweiss Business Cycle Fund can be suitable for investors looking for a systematic and dynamic approach to equity investing, focusing on navigating business cycles and potentially generating long-term capital appreciation.

The Business Cycle Fund’s stock selection process is driven by a factor-based approach that aims to capture trends in the business cycle and construct a well-diversified portfolio of top-performing stocks across different market capitalizations.

Note: This new fund offer is for education purposes only. Please consult your financial advisor before investing.