Weekly Market Recap

Weekly Market Update: This week Nifty has reached a new high, investors gained a lot in Indian Stock market. Paint Industry is facing challenges, movements in IT sector and found various sentiments in other sectors.

Let’s checkout weekly market update

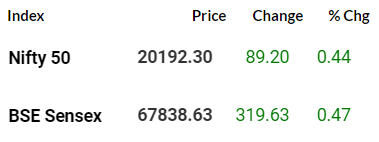

Market Strength: The benchmark indices have demonstrated resilience, with the NIFTY50 index surpassing the 20,100 mark. This positive momentum has translated into gains for 28 of the NIFTY50 stocks, marking a bullish trend.

Inflationary Trends: India’s wholesale price inflation has recorded a notable decline, contracting by 0.52% on a year-on-year basis in August. This comes after a 1.36% drop observed in July.

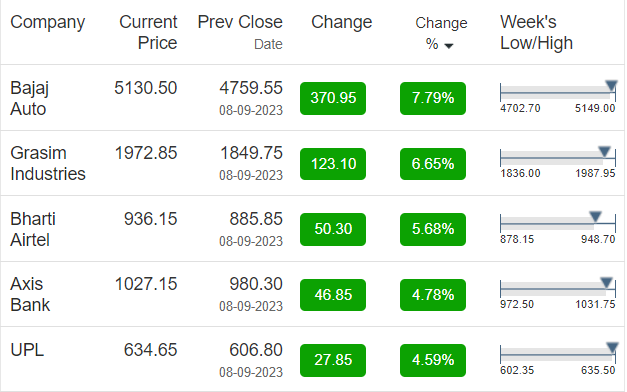

Sectoral Performance: Among the NIFTY sectoral indices, the Auto sector took the lead with a 1.5% gain, followed closely by the Information Technology (IT) sector, which posted a 0.9% increase. Conversely, the Oil & Gas sector faced headwinds, experiencing a 0.7% decline, while the Fast-Moving Consumer Goods (FMCG) sector dipped by 0.4%.

NSE Weekly Gainers:

BSE Weekly Gainers

Recent Market Trends:

Challenges in the Paint Industry: Significantly, prominent players in the paint industry, including Asian Paints, Berger Paints, and Kansai Nerolac Paints, have witnessed declines in their stock prices, ranging from 1% – 3%, over the past two trading sessions. This decline coincides with a surge in global crude oil prices, with Brent crude hovering around $94 per barrel. This has raised concerns due to several raw materials used in the paint industry being petroleum-based, potentially resulting in increased input costs for paint companies.

Infosys’ Significant Agreement: The IT giant, Infosys, has garnered attention by securing a substantial global agreement aimed at enhancing digital experiences through Infosys platforms and AI solutions. The estimated value of this deal is a significant $1.5 billion, spanning a 15-year period, contingent upon the finalization of a master agreement by both parties. Additionally, Infosys has expressed its consideration of an interim dividend, coinciding with the release of its second-quarter results. Infosys shares concluded the trading day at ₹1,512 apiece, reflecting a modest 0.3% increase.

Positive Momentum for Mishra Dhatu: Shares of Mishra Dhatu Nigam witnessed a commendable increase of 2.4% today, bolstered by optimistic statements from company management. The public sector metal company has already secured orders totaling ₹600 crore in the current fiscal year and is setting its sights on a revenue target of ₹1,200 crore. Furthermore, the company anticipates a substantial 30% contribution to revenue from the space segment, with potential incremental revenue of ₹300 crore stemming from newly commissioned facilities.

Shakti Pumps’ Achievement: Shakti Pumps celebrated a notable achievement, with its shares surging by an impressive 10% today. This surge was triggered by the acquisition of a new work order valued at ₹293 crore from the Department of Agriculture, Uttar Pradesh. The scope of this project involves the supply, installation, and commissioning of solar water pumping systems, with a stipulated completion period of 90 days.

Focus on the Hospital Sector: India’s leading hospital chain operators have been performing exceptionally well, with shares of Apollo Hospitals, KIMS, and Narayana Hrudayalaya registering gains ranging from 2% to 7% this month. This positive momentum coincides with the healthcare sector potentially undergoing a re-rating by prominent rating agencies.

Also Read: Best Path to Earn Rs. 1,000 Daily in the Dynamic Indian Share Market of 2023

Operational Improvements: Hospital chains in India are witnessing consistent improvements in crucial operational metrics, including higher occupancy rates and increased average revenue per occupied bed (ARPOB). For instance, Apollo Hospitals reported a bed occupancy rate of 62% in Q1 FY24, representing a 2% year-on-year increase. Simultaneously, its ARPOB exhibited an impressive 11% growth, reaching ₹57,760 during the same period.

Positive Projections: A recent report by ICRA suggests that the hospital industry is poised for robust occupancy levels of 60-65% in the current fiscal year. Additionally, the industry’s ARPOB is expected to increase by 5-7% due to annual price adjustments made by hospitals to offset cost inflation. Furthermore, organized players are gaining market share as patient preferences shift toward larger hospitals, and increased health insurance penetration is anticipated to boost occupancy rates.

Expansion Initiatives: Hospital operators are actively investing in expanding their capacity. For example, Narayana Hrudayalaya plans to increase its bed capacity from 8,240 beds in FY23 to 11,363 beds in FY24. Moreover, larger hospitals are exploring opportunities for inorganic growth, including mergers and acquisitions of smaller hospital chains, which could increase bed capacity and revenue.

Other Influential Factors: India’s burgeoning medical tourism industry, known for providing high-quality medical services at competitive costs, is projected to reach $13 billion by 2026. Additionally, increased health insurance coverage and heightened awareness of healthcare, particularly in the post-Covid era, are expected to benefit hospital operators.

In summary, the financial landscape is marked by diverse trends and developments, offering valuable insights to investors and analysts as they navigate the dynamic world of stocks and investments.

- Top NFO Review – Edelweiss Business Cycle Fund – New Fund Offer Review 2024

- A Detailed Fundzbazar Review 2024: Unveiling the Platform’s Full Potential

- Zerodha Review 2024 – Zerodha Brokerage, Demat Account, Best Trading Platforms & Apply Now

- Decoding the Mystery of Juniper Hotels IPO – Evaluation, Financials, Risks, Review and Beyond

- Nifty 50 Stock List